The Importance of Beta Hedging (Part 1)

Whenever we have a trading strategy of any sort, we need to be considering the impact of systematic risk. There needs to be some risk involved in a strategy for a return above the risk-free rate, but systematic risk poisons the well, so to speak. By its nature, systematic risk provides commonality between the many securities in the market that cannot be diversified away. As such, we need to construct a hedge to eliminate it.

Bet Correlation and Forecasts

We define a bet as the forecast of the residual of a security return. This forecast can be implicit – i.e., we buy a stock, and thus we forecast that the stock price will rise.

What are residuals? Without getting into the math, residuals are the difference between what is observed in the sample and what is predicted by the regression. Let’s work through three examples. We use the Ledoit-Wolf covariance estimator to assess our covariance in all cases.

The “No Hedge” Example

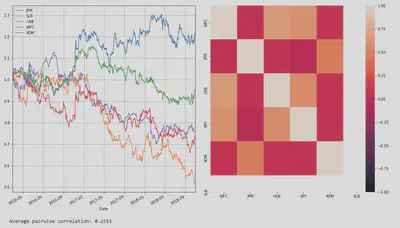

If we go long on a set of securities, without any short position, there is no hedge! So the residual is the stock return itself.

tickers = ['WFC', 'JPM', 'USB', 'XOM', 'SLB']

end = datetime.date(2018,10,30)

beg = end - relativedelta(years = 3)

historical_prices = pd.DataFrame(yf.download(tickers, start=beg, end=end))

rets = historical_prices['Close'].pct_change().fillna(0)

lw_cov = LedoitWolf().fit(rets).covariance_

def extract_corr_from_cov(cov_matrix):

d = np.linalg.inv(np.diag(np.sqrt(np.diag(cov_matrix))))

corr = d.dot(cov_matrix).dot(d)

return corr

fig, (ax1, ax2) = plt.subplots(ncols=2, figsize=(15,9))

fig.tight_layout()

corr = extract_corr_from_cov(lw_cov)

# Plot prices

left = historical_prices['Close'].plot(ax=ax1)

left.grid()

left.set_xlim([beg, end])

# Plot covariance as a heat map

right = sns.heatmap(corr, ax=ax2, fmt='d', vmin=-1, vmax=1, xticklabels=tickers, yticklabels=tickers)

As we can see, the pairwise correlation is 54%, which is a relatively moderate correlation. What does that mean? It basically means that our stocks will move in tandem majority of the time, so their will be almost no hedging. When USB goes up, chances are WFC and XOM will also go up as well. The fast majority of stocks are highly correlated with WFC, with the except of JPM.

Beta Hedge

Now we will assume the bet is hedged against the overall market, namely the S&P 500. For this, we will use a technique known as Beta Hedging.

What is Beta?

Factor models are a way of explaining the returns of one asset with a linear combination of the returns of the other assets. The general form of a factor model is

If it looks familiar, that’s because the model is similiar to a linear regression. An asset’s beta to another asset is just the

If we used the model

tickers = ['WFC', 'JPM', 'USB', 'SPY', 'XOM', 'SLB' ]

historical_prices = pd.DataFrame(yf.download(tickers, start=beg, end=end))

rets = historical_prices['Close'].pct_change().fillna(0)

market = rets['SPY']

stock_rets = rets.drop('SPY', axis=1)

residuals = stock_rets.copy()*0

for stock in stock_rets.columns:

model = sm.OLS(stock_rets[stock], market.values)

results = model.fit()

residuals[stock] = results.resid

lw_cov = LedoitWolf().fit(residuals).covariance_ # Calculate Ledoit-Wolf Estimator

fig, (ax1, ax2) = plt.subplots(ncols=2, figsize=(15,9))

fig.tight_layout()

corr = extract_corr_from_cov(lw_cov)

left = (1+residuals).cumprod().plot(ax=ax1)

left.set_xlim([beg, end])

left.grid()

right = sns.heatmap(corr, ax=ax2, fmt='d', vmin=-1, vmax=1, xticklabels=tickers, yticklabels=tickers)

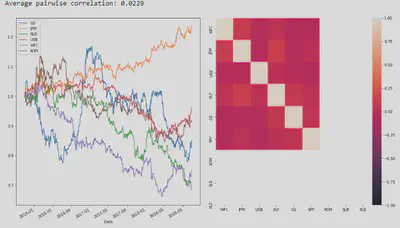

As we can see, beta hedging brought down the average correlation significantly. The only downside with Beta Hedging is that you cannot diversify away from the systemic risk. However, you can mitigate this by hedging with sector exposure. There is no hedge if we go long on a set of securities but do not hold any short positions! So the residual is the stock return itself.

Sector Hedge

The sector return and the market return are themselves highly correlated. As such, you cannot do a multivariate regression due to multicollinearity, a classic violation of regression assumptions. To hedge against both the market and a given security’s sector, you first estimate the market beta residuals and then calculate the sector beta on those residuals.

Here,

tickers = ['WFC', 'JPM', 'USB', 'XLF', 'GS', 'SPY', 'XOM', 'SLB', 'XLE']

historical_prices = pd.DataFrame(yf.download(tickers, start=beg, end=end))

rets = historical_prices['Close'].pct_change().fillna(0)

# Get market hedge ticker

mkt = rets[['SPY']].columns

# Get sector hedge tickers

sector_1_hedge = rets[['XLF']].columns

sector_2_hedge = rets[['XLE']].columns

# Identify securities for each sector

sector_1_stocks = rets[['WFC', 'JPM', 'USB']].columns

sector_2_stocks = rets[['XOM', 'SLB', 'GS']].columns

market_rets = rets[mkt]

sector_1_rets = rets[sector_1_hedge]

sector_2_rets = rets[sector_2_hedge]

stock_rets = rets.drop(['XLF', 'SPY', 'XLE'], axis=1)

residuals_market = stock_rets.copy()*0

residuals = stock_rets.copy()*0

model = sm.OLS(sector_1_rets.values, market.values)

results = model.fit()

sector_1_excess = results.resid

model = sm.OLS(sector_2_rets.values, market.values)

results = model.fit()

sector_2_excess = results.resid

for stock in sector_1_stocks:

# Calculate market betas for sector 1 stocks

model = sm.OLS(stock_rets[stock], market.values)

results = model.fit()

# Calculate residual of security + market hedge

residuals_market[stock] = results.resid

# Calculate sector beta for previous residuals

model = sm.OLS(residuals_market[stock], sector_1_excess)

results = model.fit()

# Get final residual

residuals[stock] = results.resid

for stock in sector_2_stocks:

# Calculate market betas for sector 2 stocks

model = sm.OLS(stock_rets[stock], market.values)

results = model.fit()

# Calculate residual of security + market hedge

residuals_market[stock] = results.resid

# Calculate sector beta for previous residuals

model = sm.OLS(residuals_market[stock], sector_2_excess)

results = model.fit()

# Get final residual

residuals[stock] = results.resid

# Get covariance of residuals

lw_cov = LedoitWolf().fit(residuals).covariance_

fig, (ax1, ax2) = plt.subplots(ncols=2, figsize=(15,9))

fig.tight_layout()

corr = extract_corr_from_cov(lw_cov)

left = (1+residuals).cumprod().plot(ax=ax1)

right = sns.heatmap(corr, ax=ax2, fmt='d', vmin=-1, vmax=1, xticklabels=tickers, yticklabels=tickers)

And here we are. The Sector hedge has brought down the correlation between our bets close to zero.